All Categories

Featured

Table of Contents

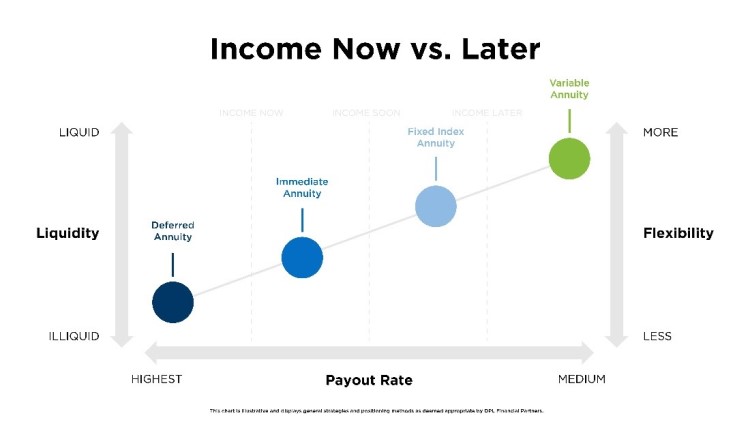

I imply, those are the different types. It's hard to contrast one Fixed Annuity, an immediate annuity, to a variable annuity due to the fact that a prompt annuity's are for a life time income. A variable annuity could be for development or should be for growth, expected development, or restricted development, okay? Same point to the Deferred Earnings Annuity and Qualified Longevity Annuity Agreement.

Those are pension plan products. Those are transfer risk products that will pay you or pay you and a partner for as long as you are breathing. But I assume that the far better relationship for me to contrast is checking out the fixed index annuity and the Multi-Year Warranty Annuity, which incidentally, are provided at the state degree.

Now, the trouble we're running into in the sector is that the indexed annuity sales pitch seems eerily like the variable annuity sales pitch but with primary security. And you're available going, "Wait, that's specifically what I want, Stan The Annuity Man. That's specifically the item I was trying to find.

Index annuities are CD products released at the state degree. Duration. And in this globe, typical MYGA dealt with rates.

The individual claimed I was going to get 6 to 9% returns. And I'm like, "Well, the good news is you're never ever going to lose cash.

Decoding How Investment Plans Work Everything You Need to Know About Choosing Between Fixed Annuity And Variable Annuity Defining the Right Financial Strategy Features of Fixed Income Annuity Vs Variable Annuity Why Choosing the Right Financial Strategy Matters for Retirement Planning Fixed Annuity Vs Variable Annuity: How It Works Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Fixed Indexed Annuity Vs Market-variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Pros And Cons Of Fixed Annuity And Variable Annuity A Beginner’s Guide to Variable Vs Fixed Annuities A Closer Look at Variable Annuities Vs Fixed Annuities

Let's just state that. And so I resembled, "There's very little you can do because it was a 10-year product on the index annuity, which implies there are surrender costs."And I constantly inform individuals with index annuities that have the one-year call alternative, and you buy a 10-year abandonment cost item, you're purchasing a 1 year warranty with a 10-year surrender fee.

Index annuities versus variable. The annuity sector's version of a CD is now a Multi-Year Guarantee Annuity, compared to a variable annuity.

Decoding Choosing Between Fixed Annuity And Variable Annuity Everything You Need to Know About Fixed Annuity Or Variable Annuity What Is the Best Retirement Option? Features of Smart Investment Choices Why Fixed Vs Variable Annuity Pros And Cons Can Impact Your Future How to Compare Different Investment Plans: Simplified Key Differences Between Indexed Annuity Vs Fixed Annuity Understanding the Risks of Long-Term Investments Who Should Consider Fixed Income Annuity Vs Variable Growth Annuity? Tips for Choosing Fixed Vs Variable Annuity Pros Cons FAQs About Fixed Index Annuity Vs Variable Annuity Common Mistakes to Avoid When Choosing Annuities Fixed Vs Variable Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Annuities Variable Vs Fixed A Closer Look at Choosing Between Fixed Annuity And Variable Annuity

It's not a MYGA, so you can't contrast the two. It really comes down to both questions I always ask individuals, what do you want the cash to do contractually? And when do you desire those legal warranties to start? That's where fixed annuities are available in. We're discussing agreements.

Ideally, that will certainly change due to the fact that the sector will make some modifications. I see some cutting-edge products coming for the signed up investment advisor in the variable annuity world, and I'm going to wait and see exactly how that all drinks out. Never ever fail to remember to live in truth, not the dream, with annuities and contractual guarantees!

Understanding Deferred Annuity Vs Variable Annuity Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial Options Why Fixed Annuity Or Variable Annuity Is a Smart Choice How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Rewards of Fixed Index Annuity Vs Variable Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing Variable Annuities Vs Fixed Annuities FAQs About Immediate Fixed Annuity Vs Variable Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Annuity Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

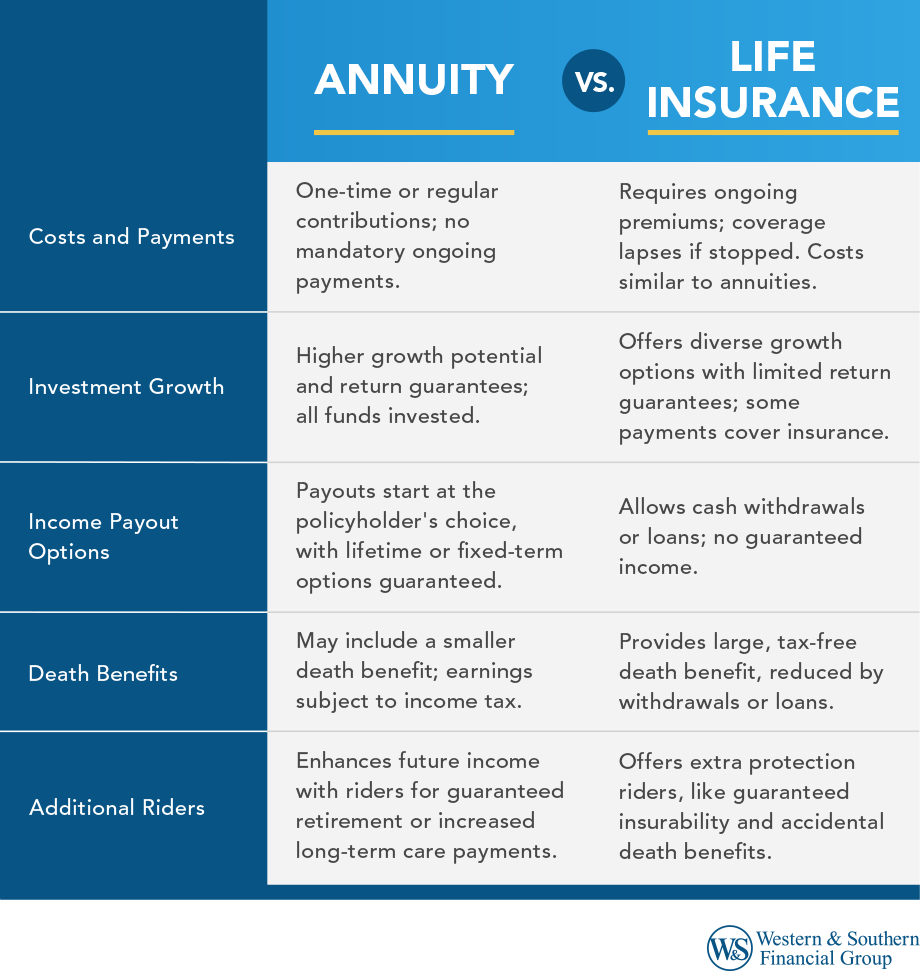

Annuities are a type of investment product that is frequently utilized for retirement planning. They can be described as contracts that supply repayments to a private, for either a details amount of time, or the rest of your life. In basic terms, you will certainly invest either a single settlement, or smaller sized frequent settlements, and in exchange, you will certainly get payments based on the quantity you invested, plus your returns.

The rate of return is set at the start of your agreement and will not be affected by market changes. A fixed annuity is a terrific choice for someone seeking a steady and predictable income. Variable Annuities Variable annuities are annuities that allow you to invest your costs right into a range of choices like bonds, stocks, or shared funds.

While this indicates that variable annuities have the prospective to supply greater returns contrasted to fixed annuities, it also indicates your return rate can change. You may have the ability to make even more earnings in this case, however you likewise risk of potentially losing money. Fixed-Indexed Annuities Fixed-indexed annuities, additionally called equity-indexed annuities, integrate both fixed and variable features.

Understanding Financial Strategies Key Insights on Annuities Variable Vs Fixed What Is Fixed Interest Annuity Vs Variable Investment Annuity? Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Risks of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Vs Variable Annuity Pros Cons FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Variable Annuities Vs Fixed Annuities

This supplies a fixed degree of earnings, as well as the chance to earn additional returns based upon other financial investments. While this generally shields you against losing revenue, it additionally restricts the earnings you could be able to make. This type of annuity is a wonderful alternative for those seeking some safety, and the possibility for high earnings.

These financiers buy shares in the fund, and the fund spends the money, based on its stated goal. Common funds include options in major asset courses such as equities (stocks), fixed-income (bonds) and cash market securities. Investors share in the gains or losses of the fund, and returns are not guaranteed.

Investors in annuities move the risk of running out of money to the insurance coverage firm. Annuities are frequently a lot more expensive than mutual funds since of this feature.

Both shared funds and annuity accounts use you a variety of options for your retirement cost savings needs. However investing for retirement is just one part of planning for your monetary future it's equally as essential to establish just how you will get revenue in retired life. Annuities usually provide more choices when it comes to acquiring this revenue.

You can take lump-sum or methodical withdrawals, or choose from the following revenue alternatives: Single-life annuity: Deals routine advantage payments for the life of the annuity owner. Joint-life annuity: Deals regular advantage repayments for the life of the annuity proprietor and a partner. Fixed-period annuity: Pays income for a defined number of years.

For aid in establishing an investment method, telephone call TIAA at 800 842-2252, Monday with Friday, 8 a.m.

Investors in capitalists annuities delayed periodic investments regular build up develop large sum, after which the payments beginSettlements Obtain fast answers to your annuity concerns: Call 800-872-6684 (9-5 EST) What is the distinction in between a taken care of annuity and a variable annuity? Set annuities pay the very same quantity each month, while variable annuities pay a quantity that depends on the financial investment performance of the investments held by the specific annuity.

Why would certainly you desire an annuity? Tax-Advantaged Investing: As soon as funds are bought an annuity (within a retirement, or not) growth of capital, rewards and rate of interest are all tax deferred. Investments into annuities can be either tax deductible or non-tax insurance deductible payments depending on whether the annuity is within a retirement or not.

Highlighting the Key Features of Long-Term Investments A Closer Look at Choosing Between Fixed Annuity And Variable Annuity What Is Indexed Annuity Vs Fixed Annuity? Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: How It Works Key Differences Between Different Financial Strategies Understanding the Risks of Variable Annuity Vs Fixed Annuity Who Should Consider Fixed Interest Annuity Vs Variable Investment Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Circulations from annuities spent for by tax obligation insurance deductible payments are completely taxed at the recipient's then current earnings tax obligation price. Circulations from annuities spent for by non-tax insurance deductible funds are subject to unique therapy since a few of the regular settlement is actually a return of funding invested and this is not taxable, simply the rate of interest or investment gain part is taxable at the recipient's then current revenue tax obligation price.

(For extra on tax obligations, see IRS Publication 575) I was reluctant at first to get an annuity on the net. When I obtained your quote record and review your evaluations I was pleased I discovered your web site. Your phone reps were constantly extremely useful. You made the whole thing go truly simple.

This is the subject of an additional short article.

Table of Contents

Latest Posts

Analyzing Annuity Fixed Vs Variable Everything You Need to Know About Financial Strategies Defining Variable Annuity Vs Fixed Annuity Advantages and Disadvantages of Fixed Indexed Annuity Vs Market-va

Decoding Tax Benefits Of Fixed Vs Variable Annuities A Comprehensive Guide to Investment Choices What Is Fixed Vs Variable Annuity? Features of Smart Investment Choices Why Fixed Annuity Vs Equity-lin

Highlighting the Key Features of Long-Term Investments Key Insights on Variable Vs Fixed Annuity What Is the Best Retirement Option? Benefits of Fixed Income Annuity Vs Variable Growth Annuity Why Cho

More

Latest Posts